Simplified Commercial Real Estate Portfolio Management

Underwrite deals 3x faster through automation (on average)

Be quicker and more accurate at identifying hidden risks, and more

Simplify deal and portfolio management and monitoring

5 out of 5 stars

4.8 out of 5 stars

The Blooma Difference

Decrease

in Origination Time

Blooma cuts out low value tasks & maximizes productivity.

Increase

in transaction volume

Enhance your tech stack for streamlined operations and powerful insights.

Reduction

in overall costs

Move away from the monotonous and back to the art of your job.

Powerful Features for Effective CRE Portfolio Management

CRE with confidence

Ready to Transform Your Commercial Real Estate Portfolio?

Request a demo today to get started.

Underwrite deals 3x faster through automation (on average)

Be quicker and more accurate at identifying hidden risks, and more

Simplify deal and portfolio management and monitoring

Manual Work Isn't Built For Enterprise Volume

Manual underwriting creates hidden costs: rework, duplicate analysis, and time lost rebuilding the same work across teams.

Ready to Start Using AI to Cut Out Low Quality Deals, Decrease Origination Time, and Increase Transaction Volume?

Don’t get left behind - Join the world’s top CRE companies in leveraging AI to streamline their CRE processes.

Trusted by Leading Commercial Real Estate Lenders and Credit Institutions

What used to take anywhere from 30-60 days now takes just a few clicks and a few minutes. From origination to portfolio management, Blooma’s automated underwriting software is bringing digital transformation to commercial real estate.

Models & Forecasting

How It Works

Set up your lending profile

Upload your deal documents

Let the platform do the work for you

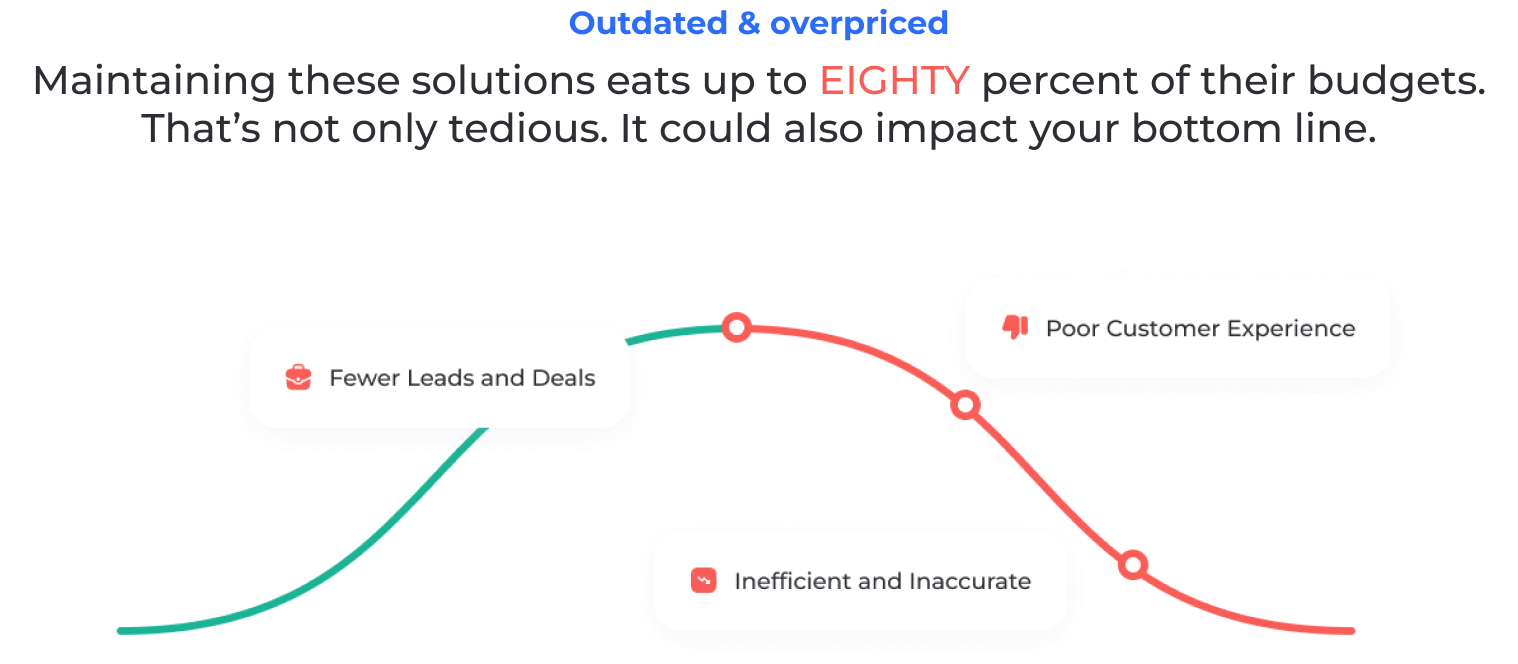

There’s a Better Way

Blooma is a fully digital commerical real estate lending solution that uses Artificial Intelligence (AI) and Machine Learning (ML) to streamline deal origination and portfolio monitoring.

Size your deals

Get to LOI in minutes — not days — with document parsing and third-party data analysis

Simplify your workflow

Integrations, bespoke reporting, and custom export options accelerate your underwriting process

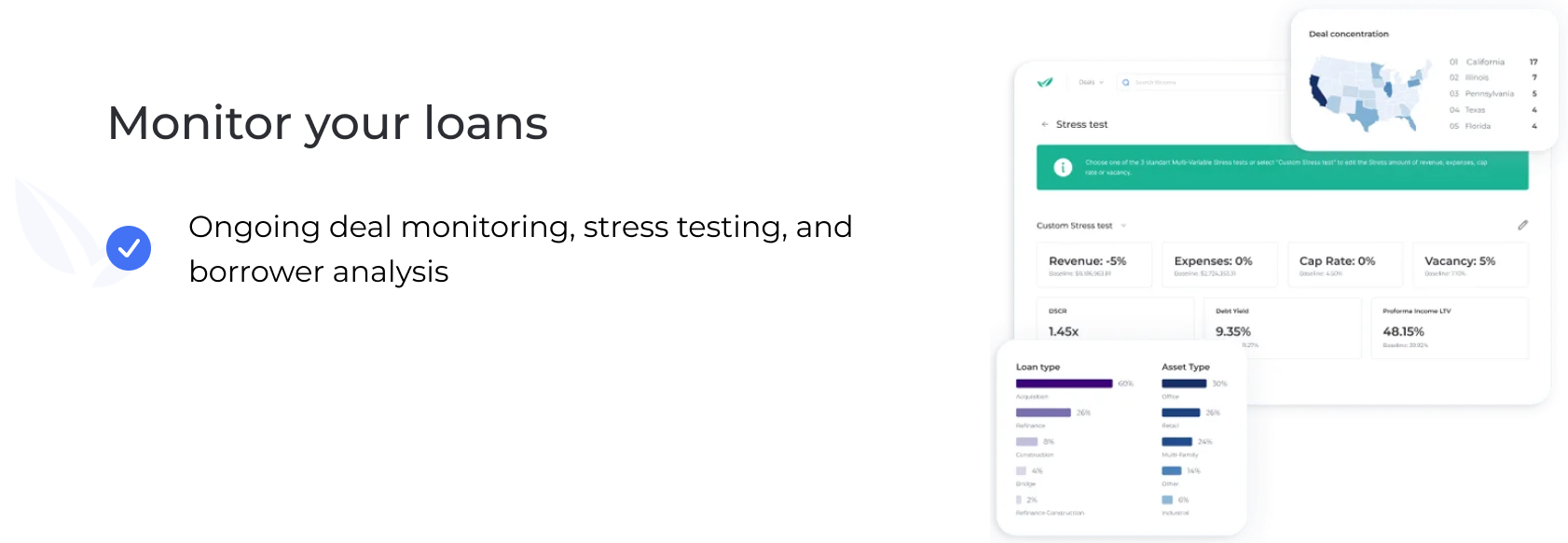

Monitor your loans

Ongoing deal monitoring, stress testing, and borrower analysis

Platform does the work for you

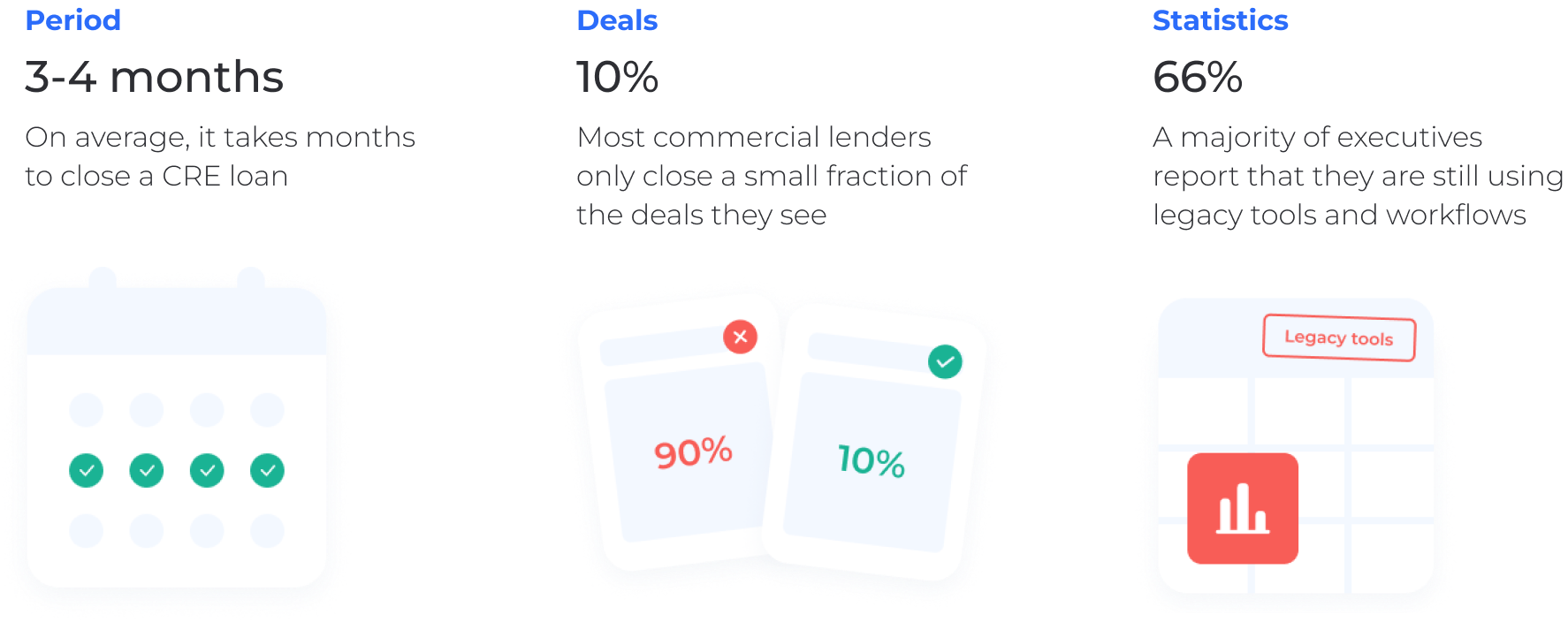

Today, the CRE Loan Production Process is Complex

see how CRE lenders remove rework without sacrificing control