Simplified Commercial Real Estate Portfolio Management

Underwrite deals 3x faster through automation (on average)

Be quicker and more accurate at identifying hidden risks, and more

Simplify deal and portfolio management and monitoring

5 out of 5 stars

4.8 out of 5 stars

The Blooma Difference

Decrease

in Origination Time

Blooma cuts out low value tasks & maximizes productivity.

Increase

in transaction volume

Enhance your tech stack for streamlined operations and powerful insights.

Reduction

in overall costs

Move away from the monotonous and back to the art of your job.

Powerful Features for Effective CRE Portfolio Management

CRE with confidence

Ready to Transform Your Commercial Real Estate Portfolio?

Request a demo today to get started.

Underwrite deals 3x faster through automation (on average)

Be quicker and more accurate at identifying hidden risks, and more

Simplify deal and portfolio management and monitoring

Ready to Start Using AI to Cut Out Low Quality Deals, Decrease Origination Time, and Increase Transaction Volume?

Don’t get left behind - Join the world’s top CRE companies in leveraging AI to streamline their CRE processes.

Trusted by The World's Largest Commercial Real Estate Investment Firms

What used to take anywhere from 30-60 days now takes just a few clicks and a few minutes. From origination to portfolio management, Blooma’s automated underwriting software is bringing digital transformation to commercial real estate.

Models & Forecasting

What Blooma Users are Saying

I’m an executive

A.J. Moyer

President and CEO of C3Bank

“C3Bank has been able to spend more time on the right deals for our bank and automate our lending process - Blooma has transformed our lending business.”

AI-powered Underwriting. Modern CRE Lending.

Blooma Makes CRE Lending Simple

Upload your deal. Get instant insights. Stay ahead of risk.

How It Works

Set up your lending profile

Upload your deal documents

Let the platform do the work for you

C3Bank has been able to spend more time on the right deals for our bank and automate our lending process - Blooma has transformed our lending business.

PRESIDENT, C3 BANK

AJ Moyer

In this very turbulent CRE environment, Blooma has enabled us to stop managing our portfolio through the rearview mirror with annual review process, and start looking through the windshield where we see property values, cap rates and future cash flows adjust based on changing market dynamics.

PRESIDENT, SUNWEST BANK

Carson Lappetito

Blooma's automation platform changed the way we manage our loan origination process. We are now able to approve the right loans which has dramatically improved the profitability of our lending processes.

LOAN OPS, ABP CAPITAL

Alexander Lange

Platform does the work for you

See How Blooma Can Help You

See How Blooma Can Help You in Your Role

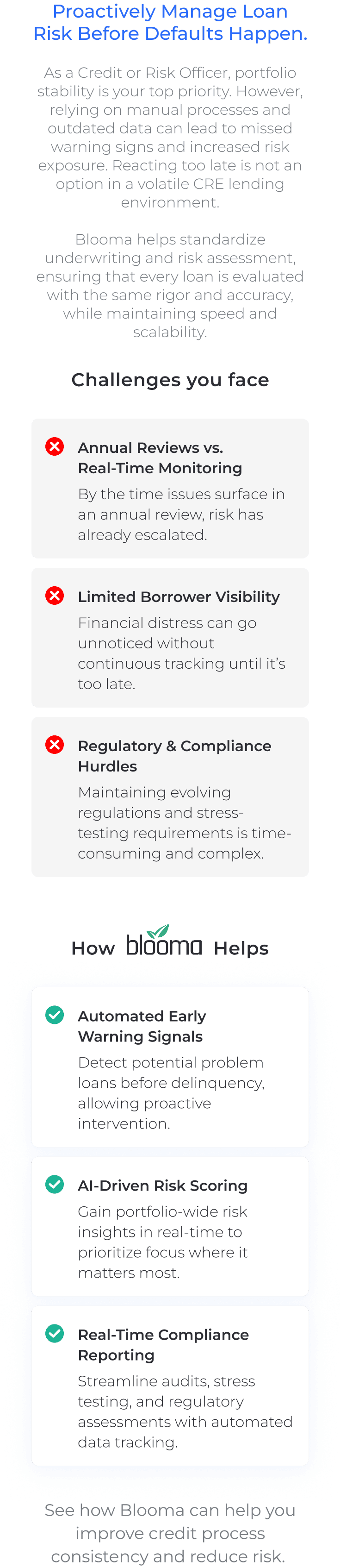

Proactively Manage Loan Risk Before Defaults Happen.

As a Credit or Risk Officer, portfolio stability is your top priority. However, relying on manual processes and outdated data can lead to missed warning signs and increased risk exposure. Reacting too late is not an option in a volatile CRE lending environment.

Blooma helps standardize underwriting and risk assessment, ensuring that every loan is evaluated with the same rigor and accuracy, while maintaining speed and scalability.

See how Blooma can help you improve credit process consistency and reduce risk.

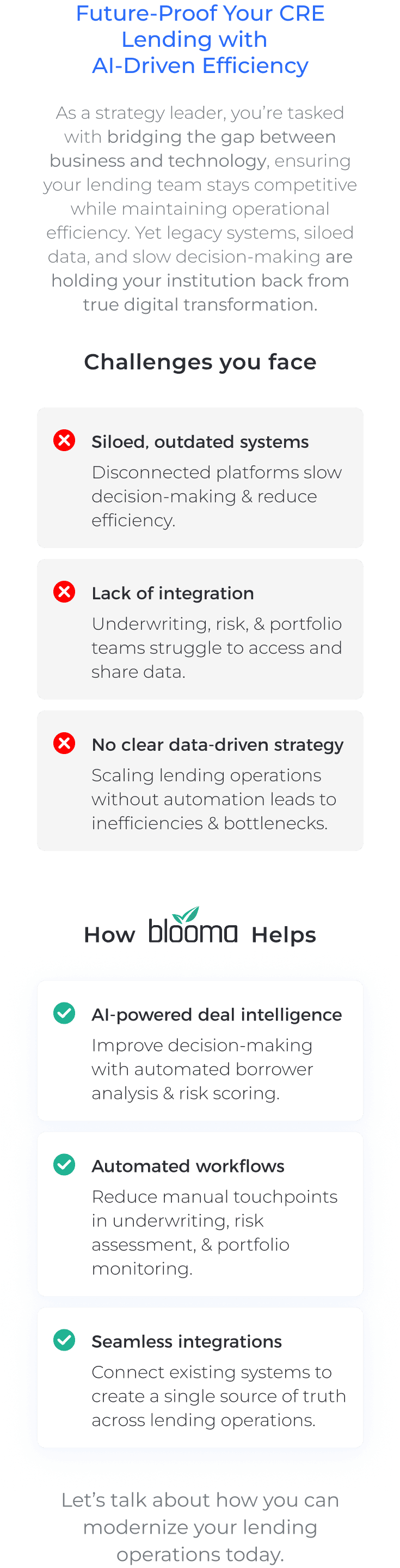

Future-Proof Your CRE Lending with AI-Driven Efficiency

As a strategy leader, you’re tasked with bridging the gap between business and technology, ensuring your lending team stays competitive while maintaining operational efficiency. Yet legacy systems, siloed data, and slow decision-making are holding your institution back from true digital transformation.

Let’s talk about how you can modernize your lending operations today.

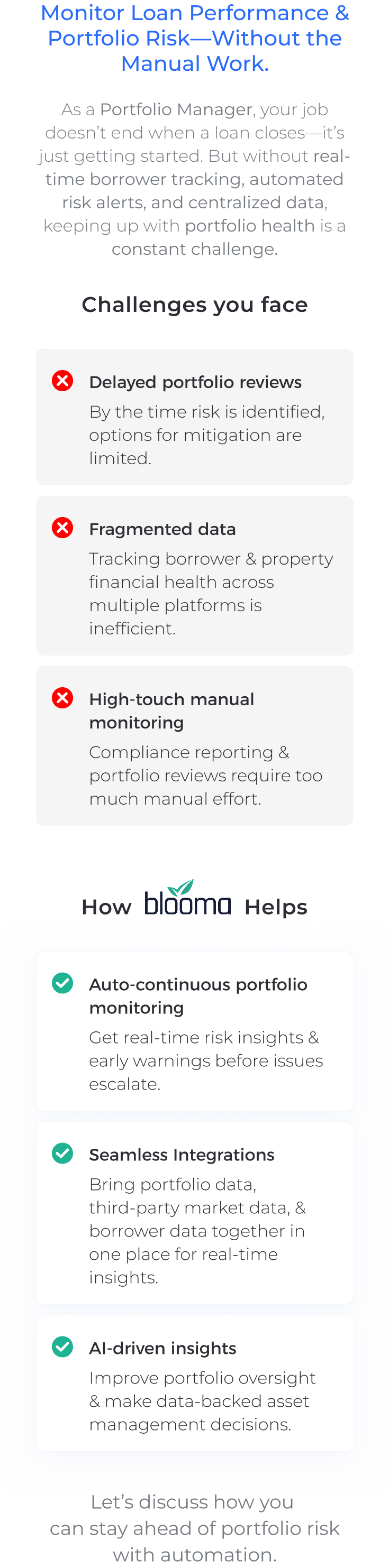

Monitor Loan Performance & Portfolio Risk—Without the Manual Work.

As a Portfolio Manager, your job doesn’t end when a loan closes—it’s just getting started. But without real-time borrower tracking, automated risk alerts, and centralized data, keeping up with portfolio health is a constant challenge.

Let’s discuss how you can stay ahead of portfolio risk with automation.

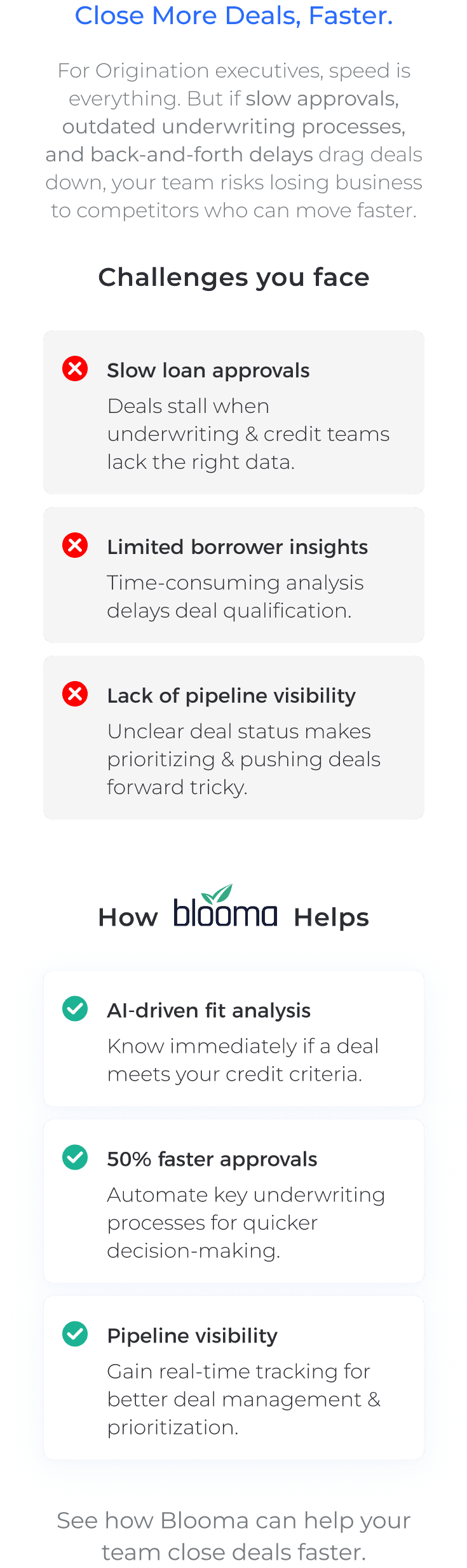

Close More Deals, Faster.

For Origination executives, speed is everything. But if slow approvals, outdated underwriting processes, and back-and-forth delays drag deals down, your team risks losing business to competitors who can move faster.

See how Blooma can help your team close deals faster.

See How Blooma

Can Help You

See How Blooma Can Help You in Your Role